Streamlining KYC Compliance: Unlocking simplified updates for legal entities with Klea

Navigating the world of KYC (Know Your Customer) regulations is a critical task for banks and financial institutions. These rules are designed to prevent financial crimes by ensuring that banks can verify the identities of their clients and understand their business operations.

For companies with many legal entities and numerous bank accounts, responding to KYC requests, especially those for periodic updates, can quickly become an administrative nightmare.

How Klea makes KYC compliance easier

Our software platform, Klea, offers a solution to the complexities of managing KYC compliance. It simplifies the process by focusing on three key areas:

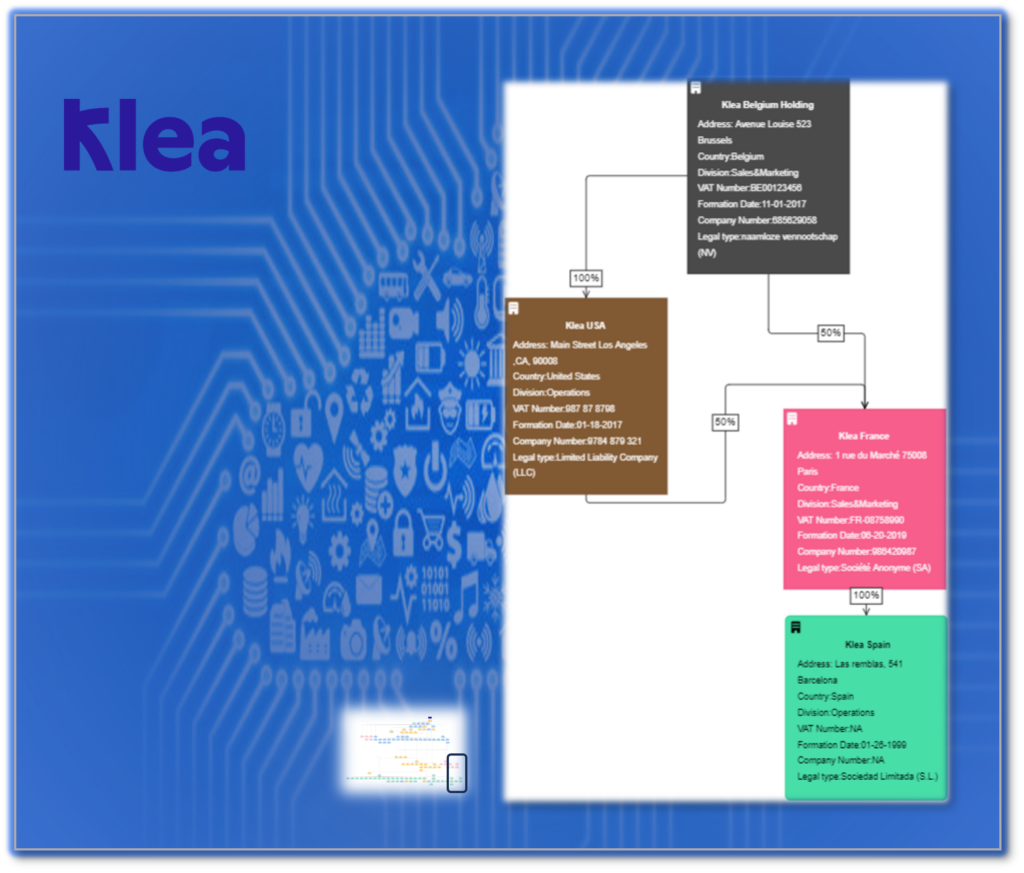

Automated Organizational Charts

Klea automatically generates clear and concise organizational charts that detail the structure and ownership of your company. This removes the burden of manually creating and updating these documents, making it easier to respond to KYC requests from banks.

Effortless Updates

With Klea, updating your company’s information becomes a straightforward task. The software is designed to quickly adjust your records and charts in response to any changes within your organization, ensuring that your KYC documents are always current and accurate.

Simplified Document Sharing

Klea’s API supports retrieving company documents so that you can for instance store these on a dedicated Sharepoint site to which you give the banks access. You could also use our Zapier integration to move these documents on a recurrent basis to any other platform your stakeholders have access to.

Conclusion

For businesses struggling with the complexities of KYC compliance, particularly those facing the challenge of periodic updates, our legal entity management software offers a much-needed respite. Klea not only simplifies the preparation and submission of necessary documentation but also ensures that businesses can meet their compliance obligations with efficiency and accuracy. Embrace the ease of Klea and focus on growing your business, secure in the knowledge that your KYC compliance is in capable hands.